Life can throw unexpected events our way when we least expect it. From illness to injury, job loss to property damage, it pays to be prepared. Protecting yourself and your loved ones is essential to maintaining your quality of life if faced with adversity.

That’s where Trusted MPA comes in.

With over 30 years of experience, Trusted MPA provides personalised protection solutions to give you peace of mind. Our expert advisers take the time to understand your unique circumstances and requirements, recommending products tailored specifically for you.

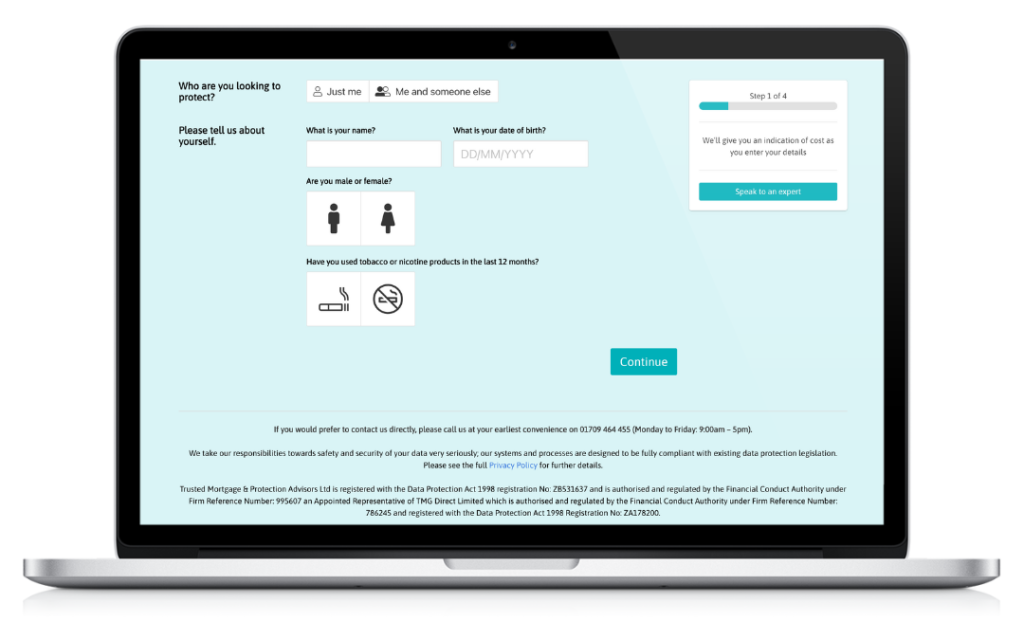

Answer a few quick questions around your circumstances and discover just how affordable proper cover can be, using the FREE Trusted online quote service.

Protecting you and your loved ones against the unexpected.

Life insurance is one of the most important protection policies you can take out. Should the worst happen, a lump sum payment could help your loved ones with expenses like mortgage repayments or childcare costs. This can provide financial security at an extremely difficult time.

Keep a roof over your family’s head if you’re diagnosed with a specified illness.

Critical illness cover is another essential protection product. A critical illness diagnosis can happen to anyone at any time, with lasting impacts on your finances. Having a policy in place means that if you were diagnosed with a specified critical illness, you would receive a tax-free lump sum payment. This could allow you to focus on your recovery without worrying about how you’ll pay the bills.

At Trusted MPA, we know having the right cover is crucial, so we’ll guide you through the range of conditions covered and tailor a policy to suit your individual circumstances.

Statutory Sick Pay (SSP) only lasts for up to 28 weeks. What are you going to do once your 28 weeks are up?

If injury or illness prevents you from working, income protection provides a regular income until you recover and return to work. The typical payout period is between 1 and 5 years. Having this safety net could mean maintaining your lifestyle and paying your bills whilst you focus on your health.

With income protection from Trusted MPA, you can have peace of mind that your finances are taken care of if you’re unable to work. Our advisers will explain how it works and provide a quote based on your unique situation.

We haven’t got a crystal ball, have you?

Owning a home is a major investment – one that deserves reliable protection. The right home insurance policy can provide crucial coverage against damage from events like floods, storms, and fires. As your mortgage and protection broker, we take the time to understand your unique needs and research policies from various leading insurers to find the best fit for you.

At Trusted MPA, your protection is our priority. Get in touch today to discuss your circumstances in more detail and get a quote for a tailored cover. Our expert team is on hand to find policies to protect what matters most, giving you peace of mind.

Our appointments are no-obligation. Whether you want a quick chat, or want to discover

your options going forward, we’re happy to help.